Select Region/Country

Global

Nigeria

Kenya

Get the card

that works.

Brought to you by the same technology that powers Nigeria’s most trusted POS, Moniepoint offers you a reliable personal banking experience.

Bank with Moniepoint.

Enjoy a transfer success rate of 99.9% and experience seamless payment transfers. Need to pay some bills, pay a business or send money to a friend? Moniepoint transfers go through every time. We mean it.

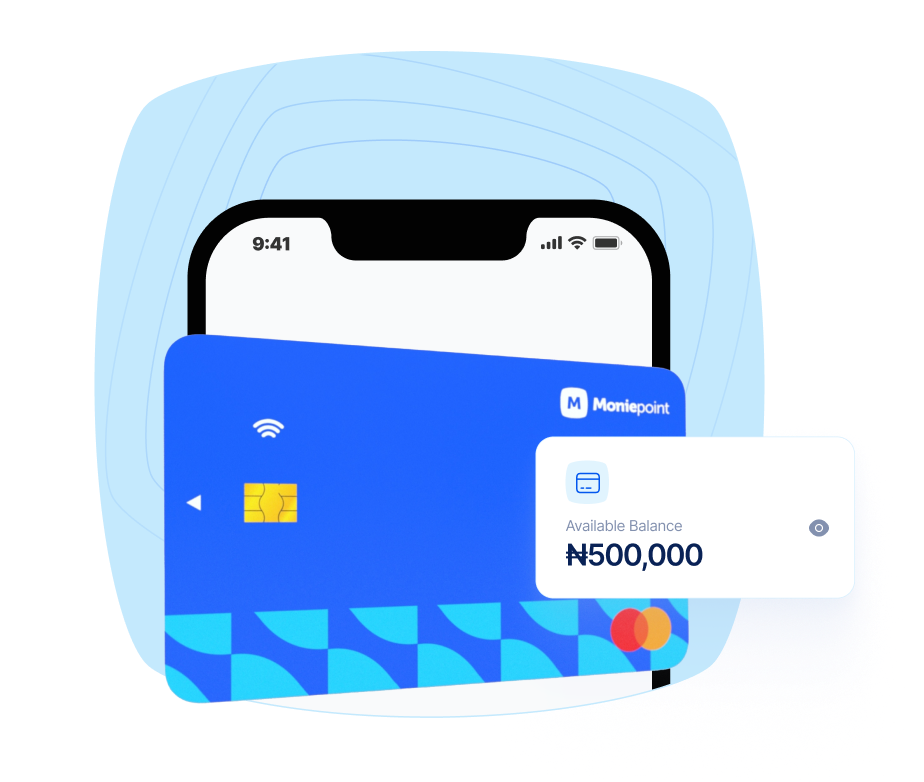

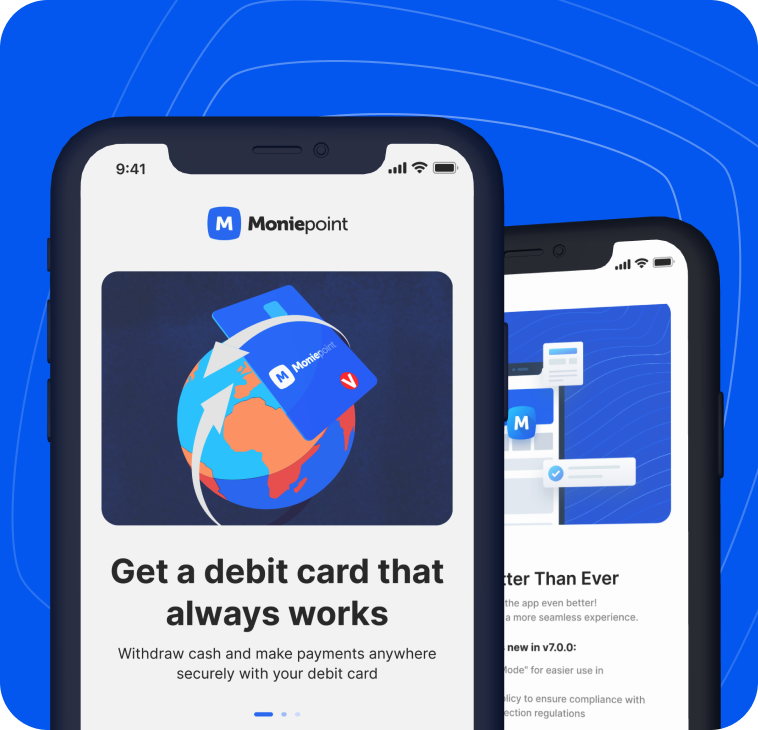

Instant Debit cards that always work

If transfers aren’t your jam, we get it. Request a debit card and have it delivered to you within 48 hours. Activate it in minutes, and start using it right away.

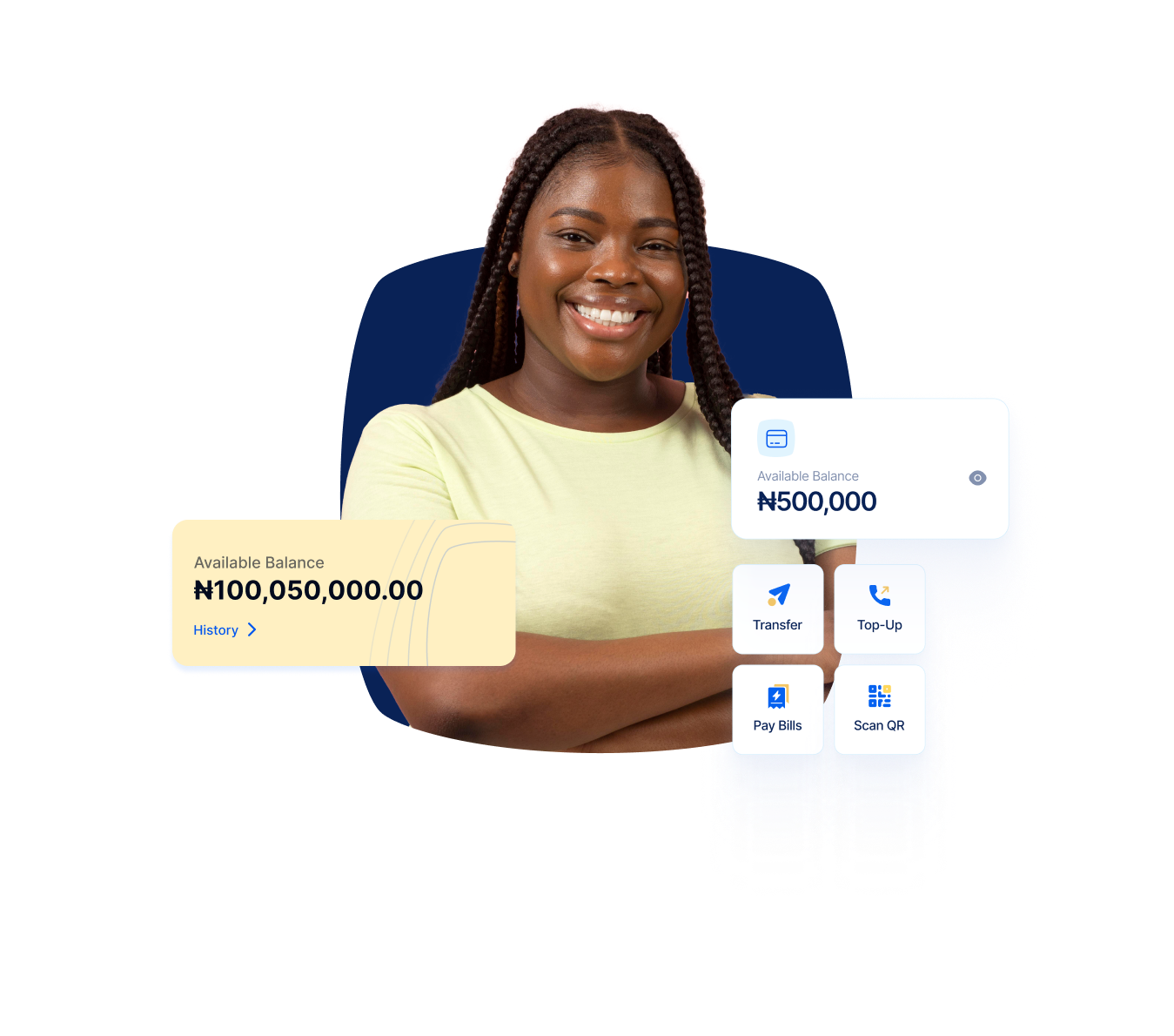

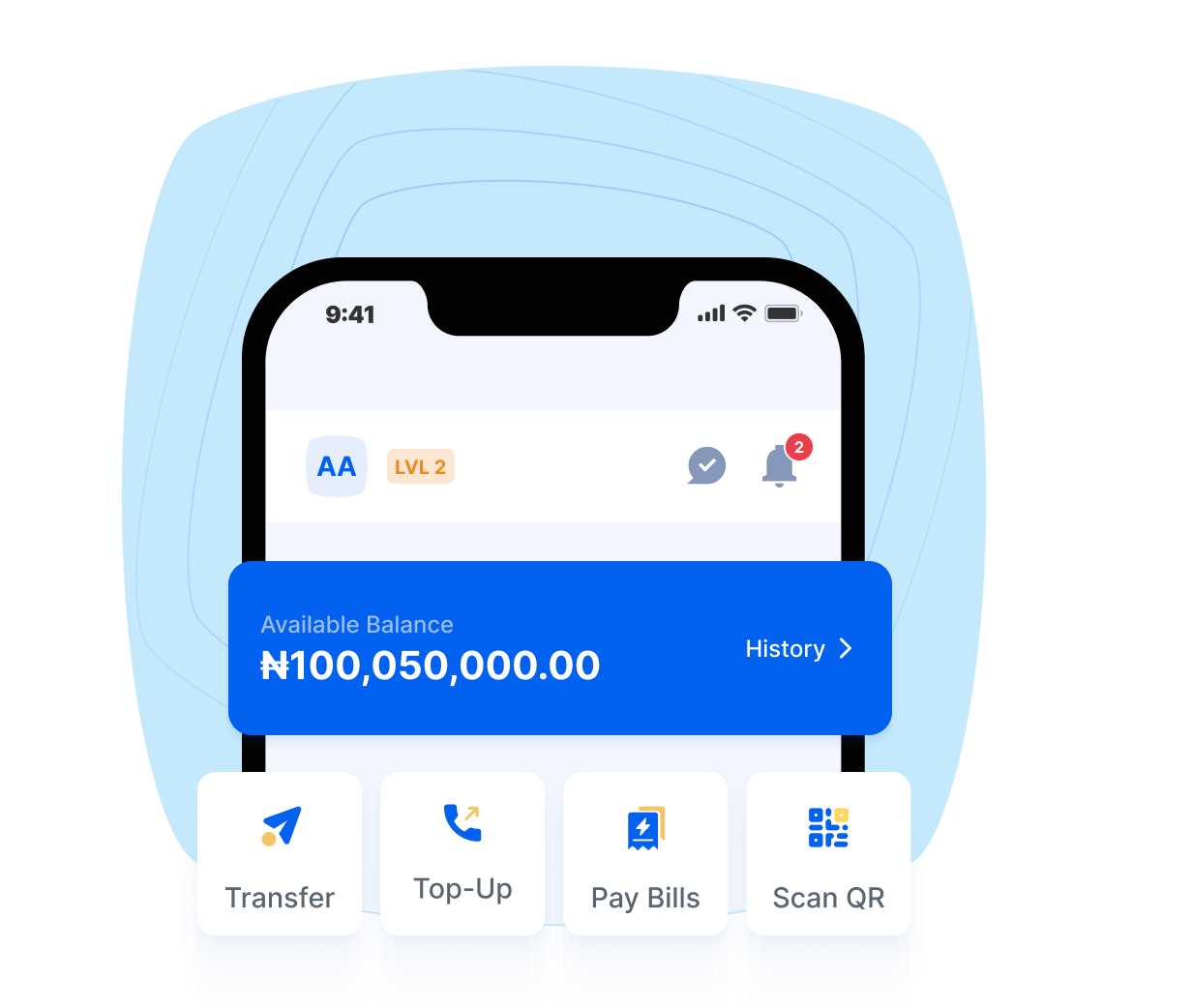

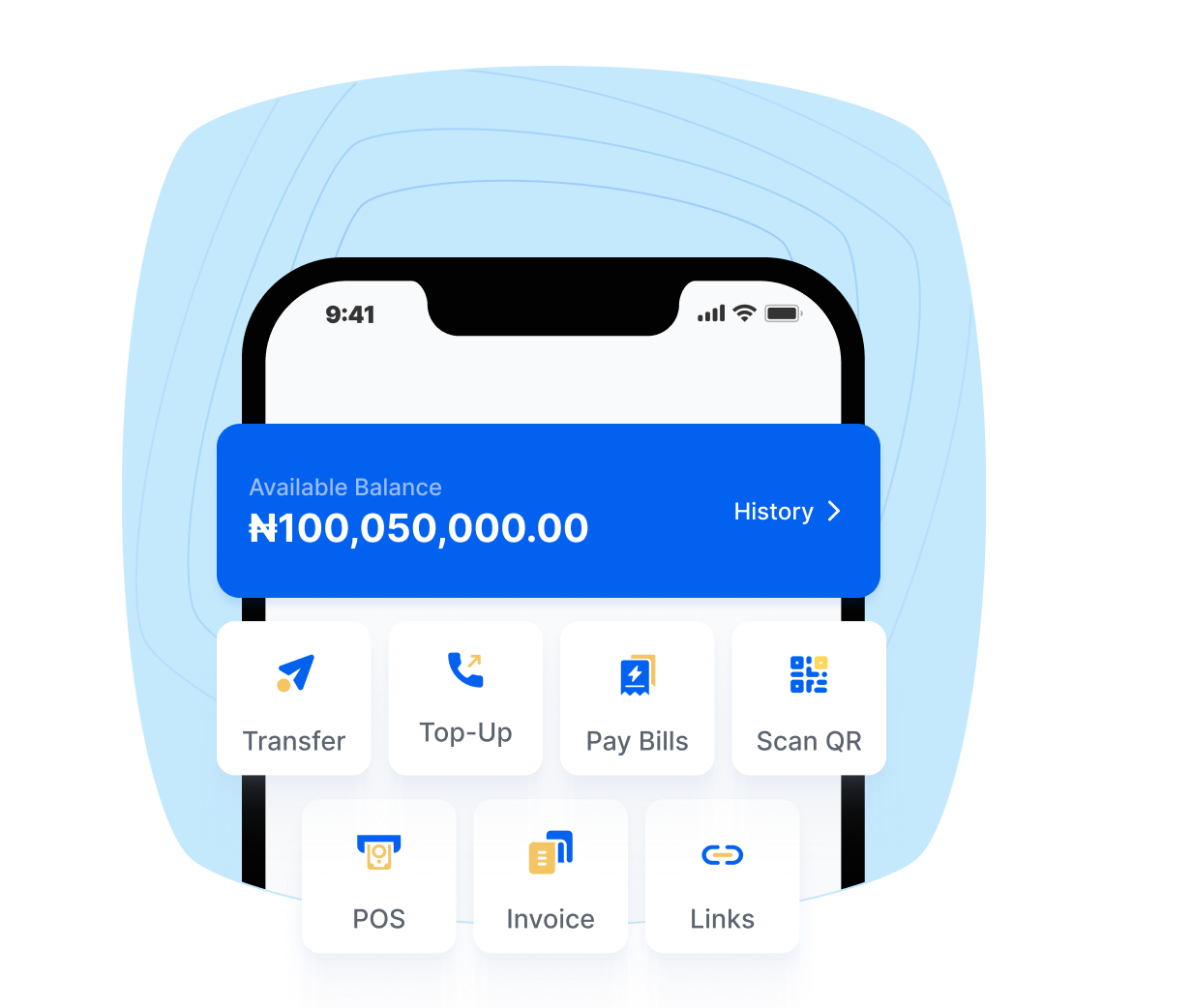

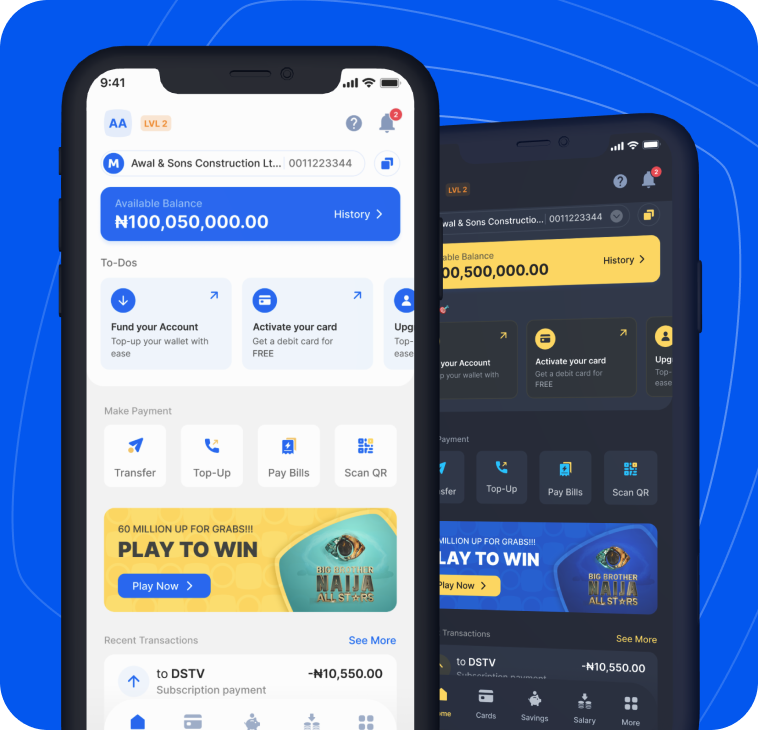

One app for all your banking needs

Need to manage your money with ease? We know that your money is important to you, and we take that seriously. Manage your money, make payments and pay bills all from our banking app.

Seamless transactions that always go through

Enjoy Smooth Money Moves! Transfer funds to loved ones, buy airtime and settle bills effortlessly. At Moniepoint, we keep your financial happiness flowing!

Other Benefits

More Reasons to Bank with Moniepoint

State-of-the-art security

Moniepoint uses up-to-date cybersecurity technology to protect your information and prevent unauthorized use

Protection and peace of mind

Your funds are insured for up to N250,000 by the Nigerian Deposit Insurance Corporation.

Upgrade Your Limits Easily

Reach for the Stars! Effortlessly upgrade your transaction limits and explore new financial possibilities.

Extra Layer of Security

Stay secure while shopping online with our virtual card feature. Shop confidently, knowing your actual card details are protected.

Say goodbye to downtimes

Pay anywhere with confidence using a banking solution that always never goes offline.

Round the Clock support

We’re always here to talk. Reach our support team however you need to - by phone, email, in the app, or check out the Help Center.

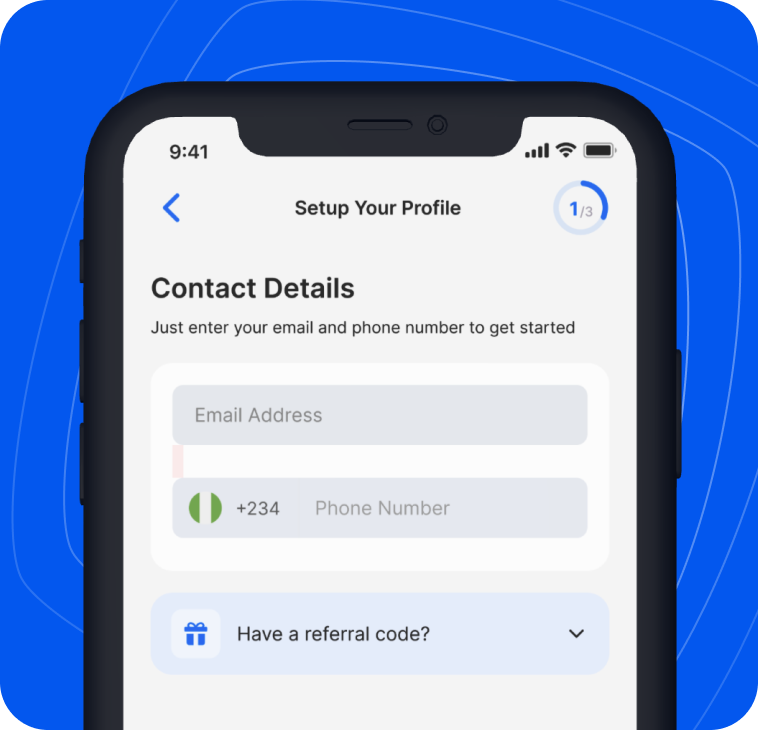

Open an account in 5 minutes

1

Fill in your details and verify your phone number

Provide your email and phone number and verify your phone number with an OTP.

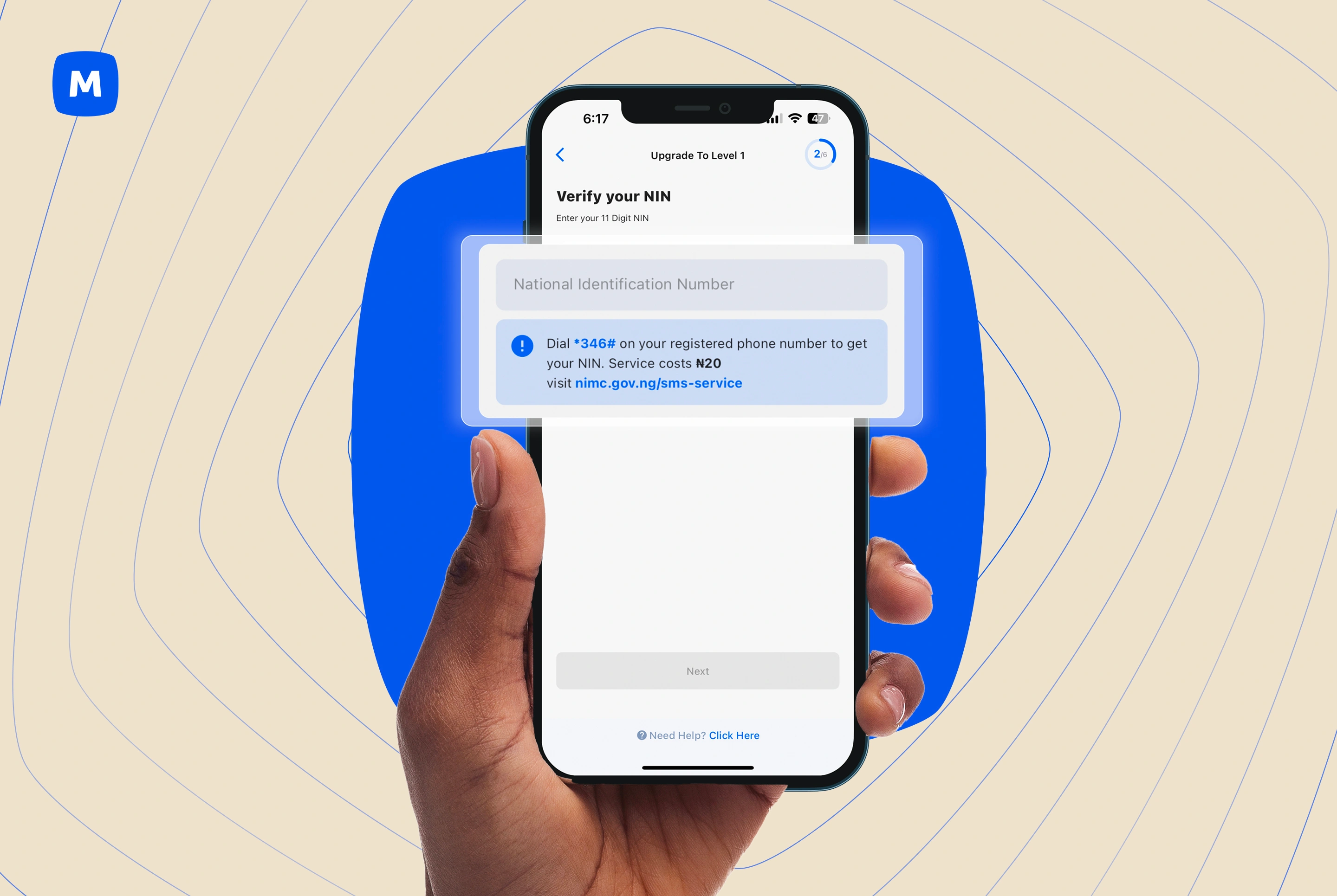

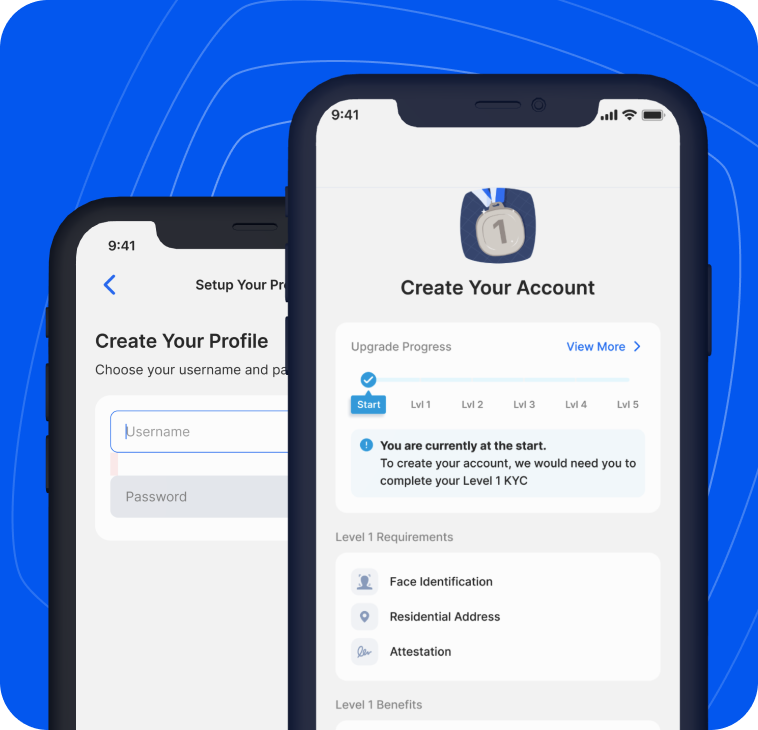

2

Get verified

Select username & password. Provide your BVN and KYC details and start face & ID verification. You can then set up a PIN for managing your account.

3

Fund your accounts

Click on "add money" to find your account details, and top up to start making transfers

4

You're done!

Click on the Card menu to order a card and get it in 48hrs.

Blogs & Articles

Discover the roadmap to financial success! Stay updated with the latest tips and trends on our blog