Select Region/Country

Global

Nigeria

Kenya

This website uses cookies to enhance your experience. Learn more here:

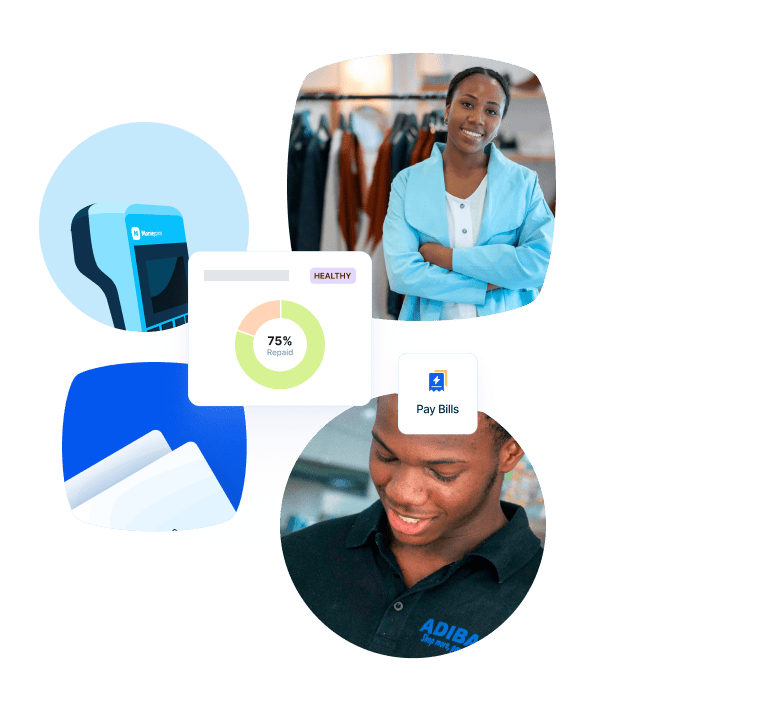

Simple solutions to power your business

Collect payments, access loans and manage operations with a business banking solution that meets all your needs.

Businesses that Count On Us

Join 5 million business owners on the Moniepoint platform

5m+

All the tools you need to run your business with ease

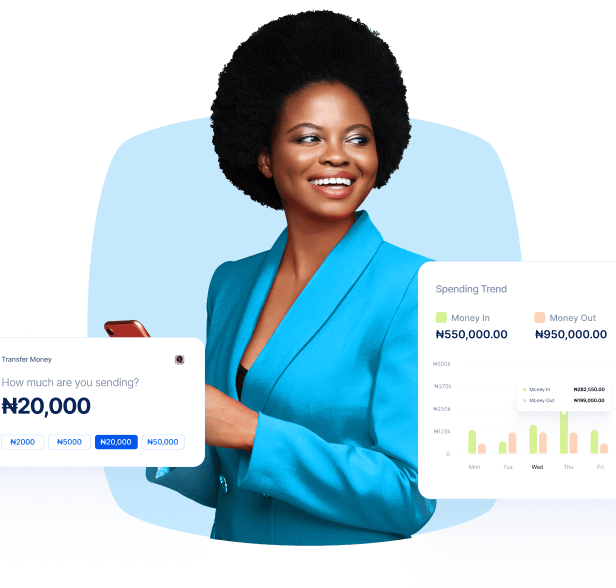

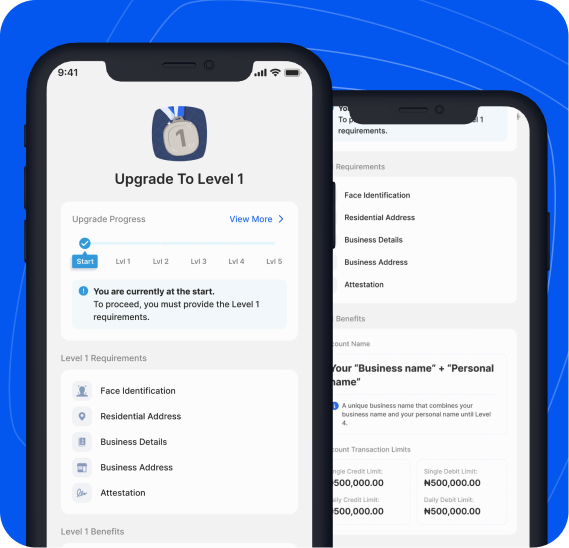

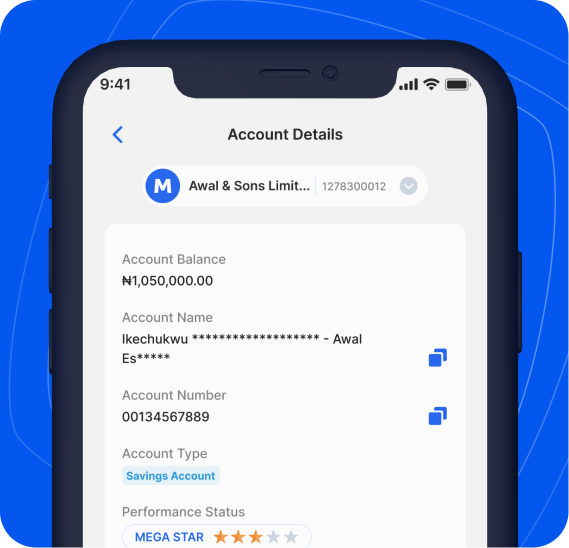

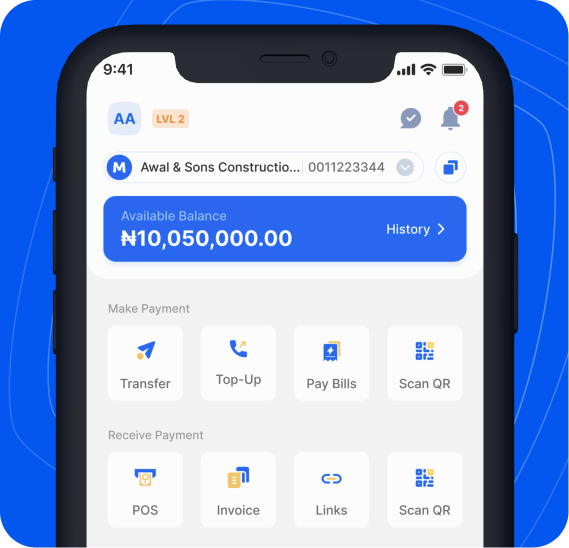

A free bank account to power your business

Open a free bank account in your business name, in minutes. Access round the clock support, with no hidden fees and complete control over your account.

POS machine wey no get wahala.

Accept card and transfer payments seamlessly, with a reliable point-of-sale terminal. Enjoy instant settlement, easy dispute resolution, and instant payments every time.

A secure card for your business expenses

Order an expense card to spend and manage your business finance effectively, and get it in 48hrs. Track your business expenses and set limits for different needs.

Flexible loans that help your business grow

Access working capital loans to help your business grow. Easy request process with business-friendly interest rates and repayment tenures.

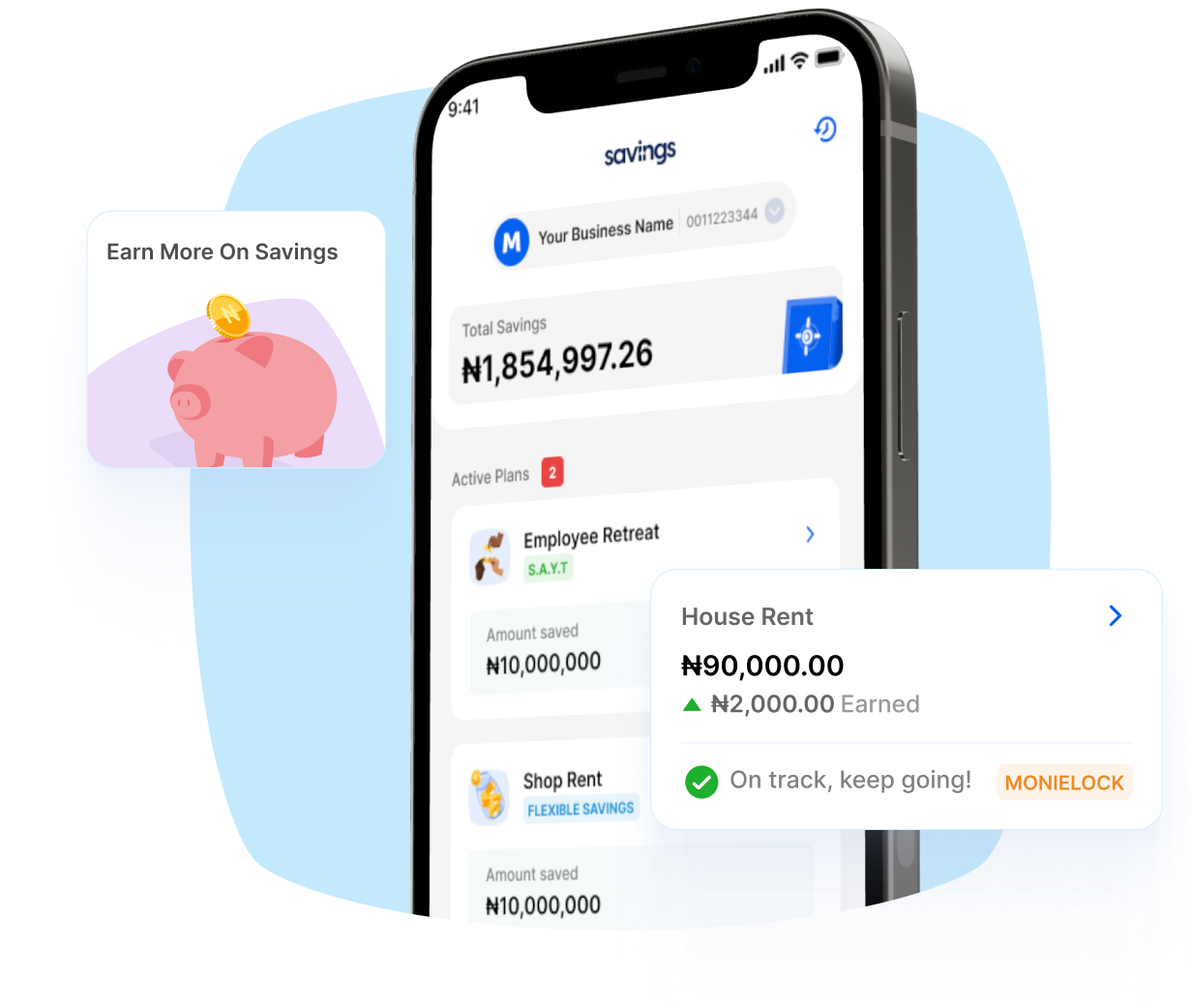

Save for your dreams

Whether you dream of travelling abroad, buying a house or owning a house you can create a savings plan for your goals and earn up to 16% interest p.a. as a reward for saving.

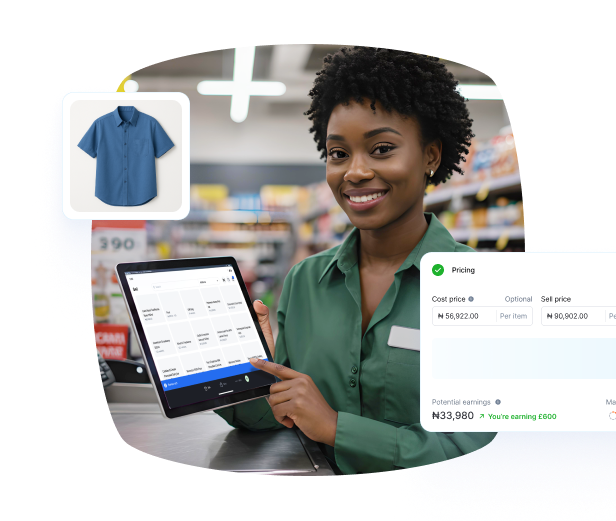

Smart POS software that sorts it all, from sales to stock

Automate how you sell, track,report, and manage your operations; no matter the size or location of your business.

Don’t just take our word for it.

I was robbed and found my shop open one fateful morning. I needed some money to cover up for the loss, and my business relationship manager mentioned the Moniepoint Loan to me. I needed it, and they gave me. Moniepoint has been a big help to my business. Without them, business will not be able to function.

Mr Joseph

Business Owner

What's more?

Explore more ways to take your business to the next level.

Manage Multiple Businesses

Easily handle multiple businesses in one place

Business Performance

Keep your finger on the pulse of your business

Easy Help

Quick and accessible support whenever you need it

How to Get Started

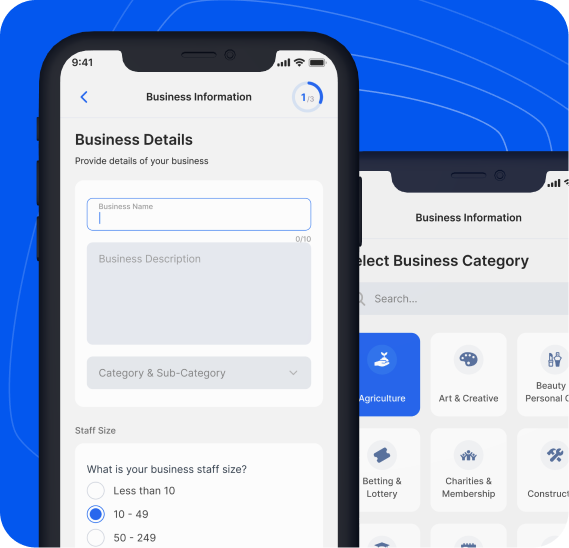

Your journey with Moniepoint starts here! Just follow these easy steps

1

Fill in your details and verify your phone number

Provide your email and phone number and verify your phone number with an OTP.

2

Get verified with your BVN and KYC details

Select username & password. Provide your BVN and KYC details and start face & ID verification. You can then provide your business name and set up a PIN for managing your account.

3

Fund your account to start making transfers.

Top up to start making transfers.

4

Access your account dashboard and apply for an expense card.

Login to your business dashboard and click on the Card menu to get an expense card.

Blogs & Articles

Discover the roadmap to financial success! Stay updated with the latest tips and trends on our blog