You're looking out the window at the clear blue sky while en route to your vacation destination and making a mental list of the activities you'll explore upon arrival. This life is just one, 'abi?' or, as Gen Z would say, YOLO (you only live once).

It all sounds good, but there's just one problem. Your manager's hard tap on your work desk just interrupted you from your daydream – again.

Living the lifestyle of your dreams, paying for that long-awaited vacation, funding your loved ones' education, planning your retirement, and pursuing your dreams with ease don't have to be a daydream.

By learning how to manage your finances, develop good money habits, and plan strategically, you can achieve financial freedom and build lasting wealth. Does it sound far-fetched? It doesn't have to be! Let's explore 10 habits you need to start now to achieve financial security.

Key Takeaways

Financial freedom is built, not wished for. With consistent habits like budgeting, saving, and setting SMART goals, anyone can gain control over their money and future.

Small steps lead to big results. You don’t need a big income to start, you need discipline, multiple income streams, and the right tools to grow what you have.

Moniepoint makes the journey easier. From high-yield savings and business loans to smart banking apps, Moniepoint helps you stay organized, earn more, and move closer to financial independence.

But First, What is Financial Freedom?

Financial freedom simply means having control over your money, and not the other way around. It's the ability to cover your wants, needs, and future plans without falling into debt traps, stress, or sleepless nights. Furthermore, it is having sufficient investments, savings, and cash on hand to afford the life you desire for yourself and your family.

Achieving financial freedom, however, doesn't happen based on wishful thinking. It requires discipline and proper habits, such as budgeting, saving, and building passive income streams. It begins with you intentionally taking control of your money.

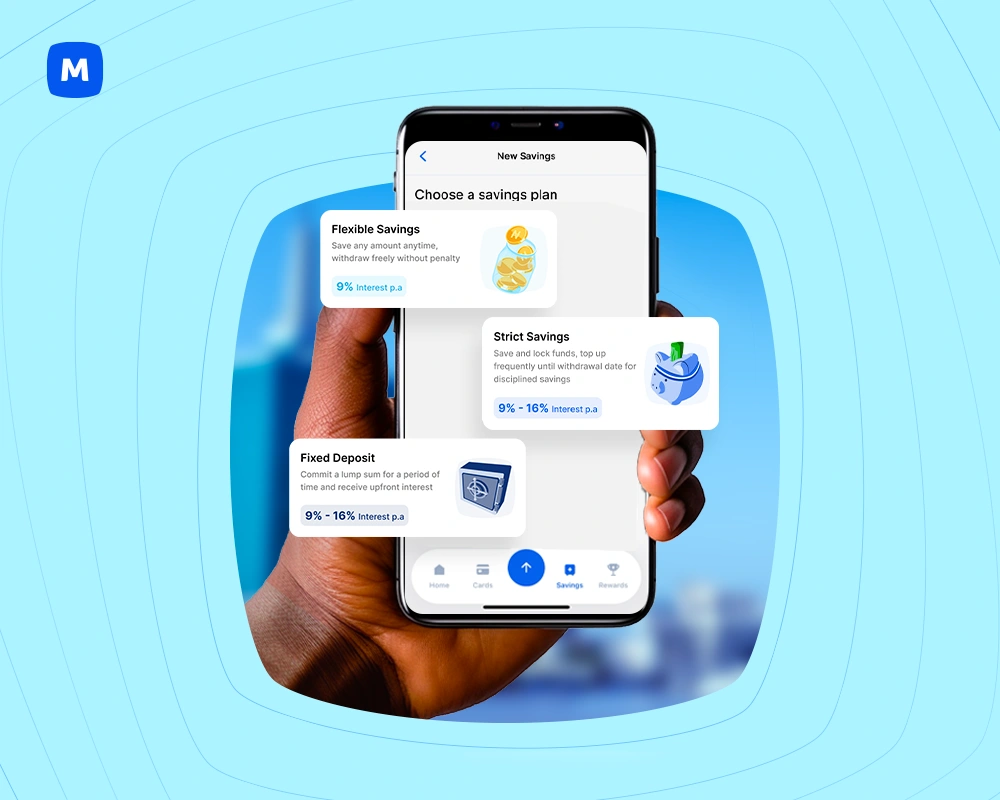

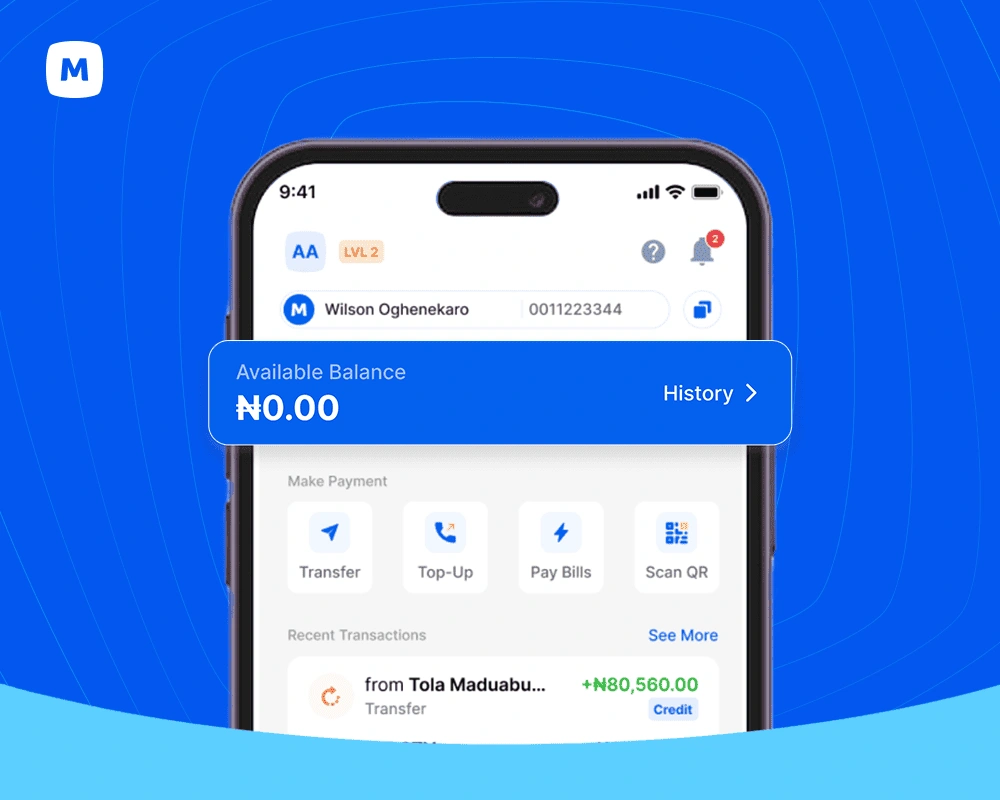

That's where Moniepoint comes in. With reliable Business and Personal Banking apps, you can manage your everyday financial transactions with ease and clarity. You can also enjoy our savings options, which enable you to earn up to 16% interest per annum, as well as access quick business loans (link to landing page).

We make managing your money smarter, easier, and more rewarding so you can focus on crushing those financial goals.

8 Habits for Financial Freedom

Now that we've established what financial freedom is, let's explore 10 practical habits you need to build to attain it.

1. Budget Like your Freedom Depends on It ( Because it Does)

Budgeting isn't about restriction; it's more about control in your money management. When you're sure of where every naira goes every day, you stop wondering where it flew off to. An ideal budget helps you save intentionally, cover essentials, and still 'flex' life without feeling guilty.

You can create a simple yet effective budget by categorising your expenses into four key areas: needs, wants, savings, and debt servicing. A common way to do so is by using the 50/30/20 rule, where 50% of your earnings goes towards necessities, such as utilities, rent, and food.

The other 30% goes to wants, such as hobbies and entertainment, while the last 20% goes towards savings and repaying your debt. Remember, the goal is progress, not perfection.

2. Prioritise Savings - Set Something Aside

Pay yourself first. After relishing the excitement that comes from the notification "ting!" of a credit alert, the next thing to do is to set aside funds for emergency purposes. Want to be financially free? Become a saver!

Whether you decide to save N500 or N60,000 daily, consistency is key. You can work towards short-term or long-term goals such as growing your business, buying a house, or retiring comfortably.

Ready to take the savings path to financial freedom? Open a Moniepoint Personal Banking account today and earn up to 16% interest per annum using our high-yield savings options. (link to savings)......

[IMAGE OF SAVINGS].

3. Avoid Unnecessary Debt — Don't Borrow to Impress

Your 'guys' are coming into town for a hangout, and you cannot afford to 'fall your hand', so you decide to take a loan and buy those rather unnecessary sneakers you've been eyeing. Or your university classmate is getting married, and you cannot 'come and carry last', so you borrow money to get the latest jewellery and handbag.

While taking care of yourself every once in a while isn't such a bad idea, getting into debt while doing so isn't great. Before taking any loan, ask yourself: Will this help me grow financially? Is this a need or a want? If the answer is no, then skip it.

When you need to access credit, do so wisely. Moniepoint offers businesses like yours flexible business loans designed to support the growth of your business. This way, you can use debt as a tool and not a trap.

4. Invest Wisely- Let Your Money Work While You Rest

Do you often sit and wonder how the billionaires of our time earn so much in seconds? Investment is the answer. While saving is good, investment is the icing on the cake. It's the line that separates you from parking your money and putting it to work.

Start investing today! It doesn't have to be with millions of naira; smart investing helps you build passive income, beat inflation, and get you ten steps closer to achieving financial freedom. Have a clear goal and think long-term, such as investing in mutual funds or stocks, reinvesting in your business, or setting up retirement accounts.

Once you can build the discipline and strategy to do so, your money can work for you while you rest.

5. Educate Yourself Financially- Knowledge Pays the Best Interest

Stay informed of changes in tax laws, financial news, and stock market trends by reading and listening to financial resources. By doing so, you learn how to save, budget, manage your investment portfolio properly, and make informed money decisions. Remember, if you do not understand how money works, it'll keep working against you.

At Moniepoint, you can stay updated on recent financial resources, enabling you to make informed money moves at all times.

6. Set SMART Financial Goals- Dream Clearly, Plan Precisely

Envisioning a fat bank account isn't a plan; it's a hope. Your journey to financial freedom begins with setting specific and clear goals. Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound goals. Rather than setting a goal like "I'll save money every day," say "I'll save N500 every day."

This way, you're not just setting vague expectations; you're defining specific money management goals. With Moniepoint's personal and business banking apps, you can track your goals, set savings targets, and stay disciplined. When your goals are clear, your progress becomes real.

7. Diversify Income Streams

Life is unpredictable; a job loss, market dip, client delay, or unforeseen illness can throw one off balance without a safety net. This is why having a diverse stream of income, such as a side hustle like blogging, freelancing, renting, or owning a small business, is essential for achieving financial freedom.

Having an extra means of income can help create a demarcation between you and financial stress. Moniepoint empowers you to manage all your earnings in one place - be it your freelance income, revenue, or savings.

With seamless Business Banking(link) features, you can stay organised and watch your income grow.

8. Stay Consistent and Adaptable — Build Habits, Not Hype

Financial freedom isn't about achieving the 'insta-worthy' lifestyle all at once. It's about the little wins repeated over time. Where does the shift between money struggles and financial freedom begin? Building consistent good money habits.

Wrapping Up

Financial freedom isn't a fantasy; it's a result of consistent, intentional action. Whether you're a freelancer, managing a household, or running a small business, the habits you build today shape the future you'll live tomorrow.

From saving with purpose to budgeting smartly, growing multiple income streams and avoiding debt, these 10 habits are your roadmap to a life with more control, more peace, and more options.

Moniepoint is here to support your journey with powerful tools, including high-interest savings (up to 16% per annum), business loans, Personal and Business Banking apps, among others. We're more than a financial platform; we're your partner in progress.

Open a Moniepoint account today and take the first step toward financial independence!